Strategic Trading Insights Into Mutual Fund Investments

In the ever-changing financial landscape, strategic commerce has emerged as a crucial element for investors aiming to make enlightened choices and optimize their profit. Mutual fund investments are emerging as one notable path that provides an assorted way of accumulating riches. This piece explores all important points attached to demat account opening, mutual funds investment strategies and benefits that give readers the necessary understanding to traverse intricate pathways in the field of finance.

Understanding Strategic Trading:

Adopting a strategic approach in trading requires careful planning when purchasing and off-loading financial assets, with the goal of leveraging market trends and openings. This method transcends simple guessing games by highlighting the importance of thorough research, analytics, and far-sightedness. More investors are steadily shifting their focus towards this tactic to progressively gather wealth while concurrently reducing risks tied to invest in stocks and unpredictable markets.

Demystifying Mutual Fund Investments:

Invest in mutual fund offers a comprehensive plan for those looking to take on exposure across several asset classes. These funds integrate capital from different investors to pour into an assorted portfolio of shares, bonds, or alternative securities. By doing so, even beginner-level investors get the chance to reap the advantages of professional wealth management and ease off risks linked with putting money in one particular security.

The Role of Demat Account Opening:

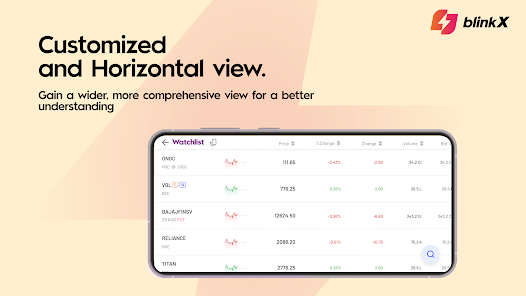

Embarking on a journey into the realm of strategic trading and mutual fund investments necessitates initiating your demat account opening process. This online platform simplifies buying and selling financial instruments by removing reliance on tangible share certificates. The seamless user experience provided by a demat account app, coupled with its effectiveness, has revolutionized how investors keep tabs on their portfolios, offering swift awareness of market changes while endorsing speedy yet secure transactions.

Intraday Trading and Its Considerations:

Strategic trading usually requires a long-term perspective, yet the exhilaration of intraday trading attracts certain investors. This approach means purchasing and disposing of financial assets within one marketplace session to profit from rapid shifts in prices. Nonetheless, it’s crucial to acknowledge that such a method demands comprehensive knowledge about market behavior plus substantial risk endurance, which makes it compatible with seasoned traders.

The Appeal of Investing in Equity:

Equity-oriented mutual funds and stocks continue to be a key focus for strategic traders. The promise of capital growth and dividends over the long term make invest in equity appealing. Though individual stock investment necessitates in-depth study and constant oversight, opting for equity mutual funds offers diversity – bringing together under trained professionals dedicated to making educated choices on investors’ behalf.

Diversification through Mutual Funds:

A significant benefit of mutual fund investment is the aspect of diversification. This process, which involves spreading your investments over multiple asset classes and sectors, reduces the negative effects that could result from a solitary investment’s underperformance. As such, diversification aids efficient risk management while fortifying the portfolio against unpredictable market shifts.

The Long-Term Benefits of Mutual Fund Investments:

The Long-Term Benefits of Mutual Fund Investments:

Placing your funds in mutual investments syncs with a lasting wealth-enhancement plan. The multiplying effect provides the investor both growth of principal and dividends reinvested over duration. This method fosters patience and restraint, underlining the key value of sustaining investment during market highs and lows.

Final Thoughts:

Insightful strategies for trading in mutual funds offer a sturdy platform to those aspiring towards sensible wealth accumulation. Be it investing in equity, delving into the exciting world of intraday trading, or selecting the multifaceted route offered by mutual funds – understanding market nuances, having a well-planned approach, and utilizing an accessible demat account app remain critical elements. Adopting these guidelines can empower investors to traverse financial territories confidently, thereby unveiling extensive prospects for enduring financial success.