Safety Precautions To Be Followed Before Borrowing Loans

In today’s fast-paced world, financial emergencies can arise anytime. Whether personal needs, medical expenses, or urgent bills arise, loans come in handy immediately. However, applying for a loan should never be taken lightly. With multiple loan apps currently available, new loan app 2023 releases included, be careful and take the necessary precautions before applying.

1. Research your loan options

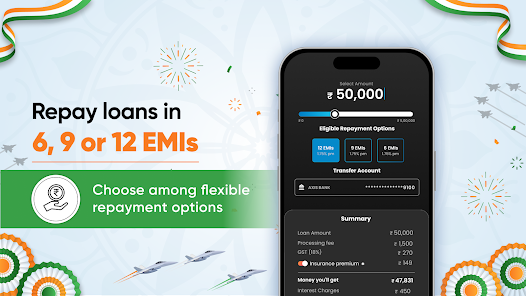

Before applying for a loan, understand the variety available in the market. Personal loan apps, as well as personal and loan apps, with recent advances in lending apps, present an excellent avenue for consumers looking to secure financing. Most applications offer wide choices of the type of amount needed, with associated interest and payback rates, so comparing each is best before making your selection.

2. Check the Interest Rates and Fees

Interest rates are one of the most crucial things to be considered before getting any loan. Especially when one is using the NBFC personal loan products, ensure that the loan terms are clear and that the interest rate, processing fees, and hidden charges are very clear. With the ease of applying through the loan app-get cash instantly, it is tempting to rush into accepting an offer. However, high interest rates and excessive fees can make repayment burdensome. Always opt for loans that offer transparent terms and interest rates that suit your budget.

3. Evaluate Your Repayment Ability

While getting carried away by the convenience of taking out a loan is easy, it’s very important to assess whether you will be able to repay the loan on time. Many personal loan apps india allow instant loan disbursal, but failure to repay on time will attract penalties and harm your credit score. Before applying, use online calculators available on most loan apps to evaluate the monthly installment and compare it with your income and expenses to ensure you can comfortably manage the repayment.

4. Look for Secure Platforms

When applying for loans through apps or online platforms, always ensure security. Look for the platform’s use of encryption & other protective measures to secure your personal and financial data. Avoid using unsecured websites or apps that may compromise your sensitive information. Choose reputable loan apps, especially the new loan app 2023 offerings, which are likely to have the latest security protocols to protect your privacy.

5. Read the Terms and Conditions

There are always terms and conditions to every loan application. They might seem long or complex, but it’s a requirement to read them to avoid misunderstandings later on. Make sure you understand the repayment schedule, late fees, and all the rest of the clause. Many borrowers skip this step with the advent of loan app personal platforms, which can save you from potential financial traps.

Conclusion:

In conclusion, though it seems convenient to acquire a loan by applying through platforms like personal loan apps in India and loan app – get cash instantly, safety measures towards your financial needs must be given importance. Thoroughly explore loan options for you, understanding the terms on which the lender is offering; check the rates of interest involved and the possible fees charged while availing loan facilities, hence ensuring that its repayment is definitely manageable. Only then can a loan facility help you without bringing your financial health into danger.