Key To Smart Investing: Why You Need A Demat Account

The stock market has become one of the most popular avenues for wealth creation, offering numerous opportunities for investors. Having a Demat account is most essential for hassle-free stock market trading. It is an electronic vault that keeps your securities electronically, and this makes buying and selling of shares easy and secure. In the following article, we will find out the important reasons why you should have a trading account and how a Demat account application can make your investing experience a better one.

1. Easy Stock Market Trading

A demat account facilitates trading in the stock market by eliminating physical share certificates. Conventional trading entailed dealing with paper-based securities, which could be lost, stolen, or damaged. With a demat account, you can trade electronically, minimizing paperwork and facilitating speedy transactions.

Additionally, through a Demat account app, investors can buy shares online with a click of a button, making trading easier and more convenient than ever.

2. Secure and Safe Transactions

One of the largest benefits of possessing a demat account is the safety it provides. Compared to physical certificates, electronic securities are safeguarded from threats such as forgery, theft, or loss. Also, all dealings are overseen and governed by the Securities and Exchange Board of India (SEBI), and thus, a safe trading environment prevails.

3. Convenient Portfolio Management

A Demat account app makes investment portfolio management more convenient. Investors can monitor their holdings, view previous transactions, and follow market trends in real time. The app offers information about stock performance, enabling traders to make optimal decisions and maximize investments.

Trading apps also enable users to create price movement alerts, corporate action alerts, and stock tips so that they never miss an investment opportunity.

4. Prompt and Easy Share Transfers

With a Demat account, share transfers are faster and easier. Whether shares are being sold or transferred to another account, electronic transfer saves time for manual paperwork and delays. It is an automated, hassle-free process where shares are bought online and sold when the market situation is appropriate.

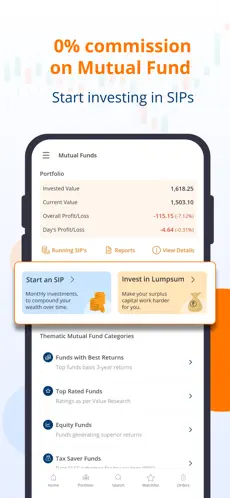

5. IPO and Other Security Access

A demat account is not only for trading stocks. Investors can use it to subscribe to Initial Public Offerings (IPOs), bonds, mutual funds, and Exchange-Traded Funds (ETFs). This offers a diversified investment strategy, enabling investors to achieve maximum returns with minimum risks.

Most trading apps have IPO alerts and application features, and this makes it easy for investors to invest in the primary market.

6. Lower Costs and High Efficiency

Opening a trading account and associating it with a demat account substantially minimizes trading costs. In contrast to physical trading, electronic transactions entail lesser brokerage charges, and no stamp duty is required on securities held electronically. Such cost-effectiveness enhances the profitability of stock market investment for retail investors.

Conclusion:

Opening a Demat account is the most essential step for anyone who wants to be part of the stock market. It makes trading in the stock market smooth, safe, and efficient and makes it easy for investors to purchase shares online. With improvements in trading apps, investing has never been easier. If you haven’t opened one, now is the right time to open trading account and begin your path to financial growth!