Unlock Credit Cards Magic & Simplify Spending With Rewards

Our ability to obtain special advantages and manage our spending has been revolutionized by credit cards. Credit cards provide ease and flexibility whether you’re handling unforeseen expenses, treating yourself to a treat, or purchasing necessities. What, though, really makes them unique? Let’s examine how credit cards can be used for purposes other than spending and enable you to get fascinating benefits like cashback and credit card incentives.

Reasons credit cards are your best friend:

You can use a credit card to manage your money more wisely than only to make purchases. Here’s why they’re so popular:

- Ultimate in convenience

Do not carry cash. Online or offline, bill payment only requires a swipe or tap.

- Cashback on every expenditure

Credit card rewards allow you to get perks for every rupee you spend. There are countless options, ranging from complimentary airline tickets to retail bargains!

- Secure transactions

Strong security features on credit cards guarantee that your money is safe while you do transactions without difficulty.

Do you know about UPI credit cards? The way that we pay is being redefined. These cards enable effortless transactions without the use of POS terminals by fusing the ease of UPI (Unified Payments Interface) with the strength of credit cards. Imagine making use of your UPI-linked credit card to make a quick, safe, and very efficient grocery or taxi reservation!

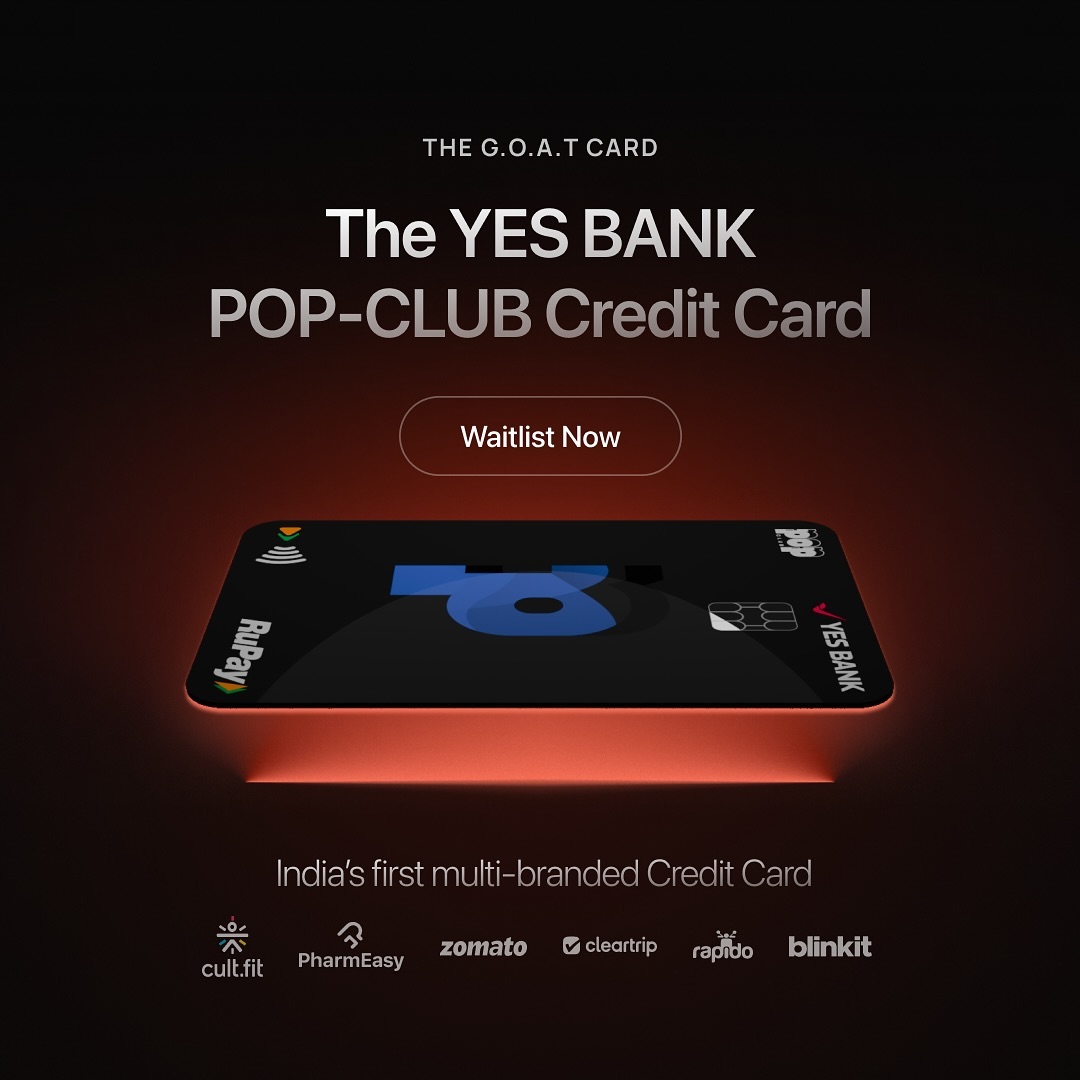

Reasons why RuPay credit cards are important?

RuPay credit card is unique when it comes to credit card selection because of their advantages and ease of use:

- Domestic focus: These cards, which are designed to fit the Indian market, guarantee dependability and widespread acceptability throughout the nation.

- Exclusive benefits: RuPay frequently collaborates with Indian retailers to give exclusive benefits like cashback and discounts.

- Low fees: RuPay credit card transactions are a great option for new customers because they are frequently less expensive.

How to select the most appropriate credit card for you?

Your spending patterns and lifestyle will determine which credit card is best for you. Here are some things to remember:

- Rewards programs: Choose a credit card with a strong rewards program if you travel or shop frequently.

- Cashback benefits: A cashback credit card could be your finest option for regular expenses.

- Special features: For further convenience, think about getting a UPI credit card if you regularly use UPI.

- Applications: Consider searching for RuPay credit cards designed specifically for Indian consumers if you’re looking for a less expensive choice.

Conclusion:

Credit cards are more than just a payment tool—they’re a gateway to rewards, savings, and financial freedom. Whether you’re drawn to the exciting benefits of credit card rewards, intrigued by the convenience of UPI credit cards, or seeking the reliability of a RuPay credit card, there’s an option tailored to your needs. Embrace the opportunity to maximize your spending potential and enjoy the countless perks that come with it. So, why wait? Take control of your finances today and unlock a world of benefits with the right credit card!